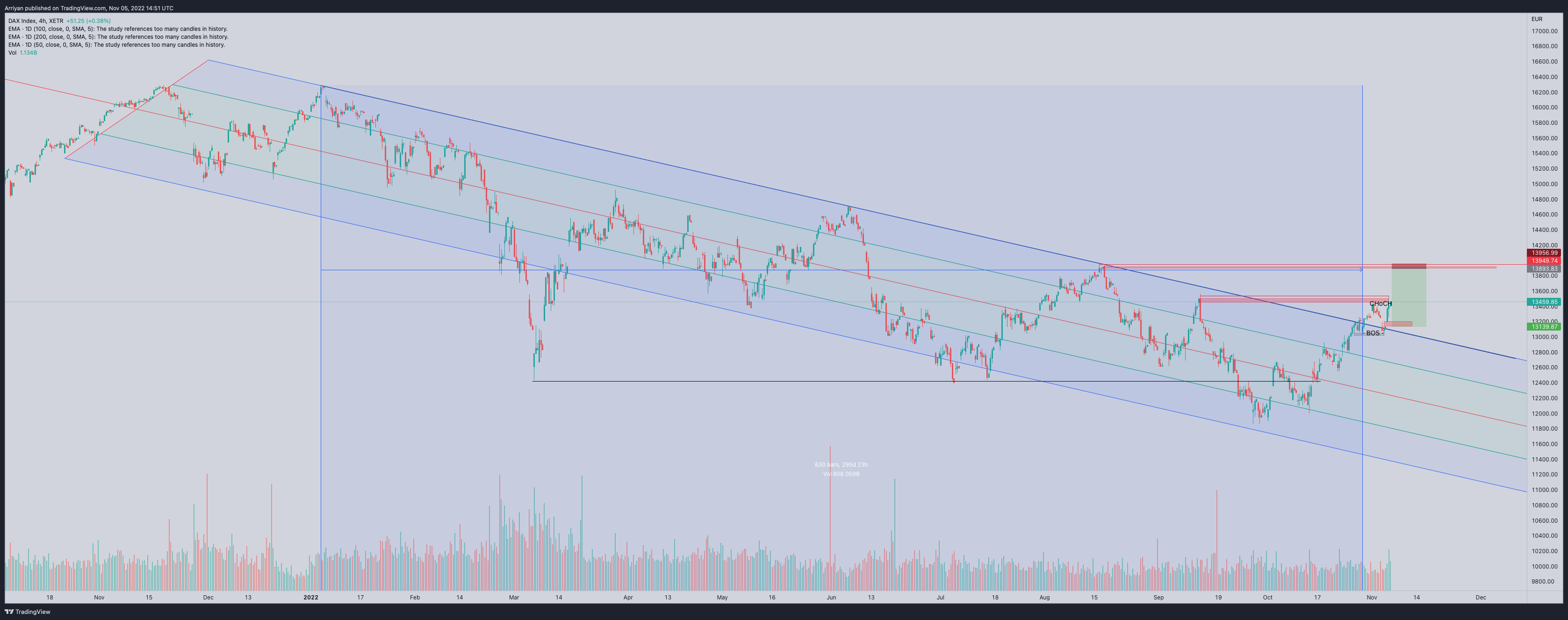

Break outs often give the best SHORT opportunities!

On Wednesday October 26th the DAX Index (,an index reflecting the stock performance of Germany’s top 40 largest, publicly traded companies) broke out of a 296 day downtrend. The Price moved up towards the previous high around $13450, where it filled a huge FVG (fair value gap) and rejected towards recent lows.

Zooming in to the 15m chart, it’s easy to see that the index made a new low during the retest and now just broke recent highs, changing the character. (BOS/CHoCH structure, will soon be discussed in the blog)

So what is next?

The chart has an actual gap to fill, collect liquidity below and move towards the previous high again. I think that we’re going to break the previous high and move towards $13900 this time, which could be a very nice short opportunity.

I’m opening the trade at $13895, with a SL at $13956. My first target will be the previous high – $13505, which is also where I’ll move my stop loss to break even. The Second ‘Take Profits’ level is yet to be determined. If you want to stay up to date, join the Free Discord Server and follow us on our socials.

Any Concerns?

Well, what does concern me is the fact that that the previous imbalance and untapped supply zone were only able to push the price back about 1% so far. So if the price doesn’t even reach the gap before it’s starts pumping again, I don’t think that the market will have enough sellers to help us succeed in this SHORT. Meaning, Bulls will be in charge and bears should scatter instead of just sitting there trading against the trend.