Monday May 1st, 2023

Hey there, dear readers! Welcome to the inaugural article, episode, or whatever you’d like to call it. Let’s dive straight into the trading day, as I have some entertaining insights to share.

Today was a successful day – a swift entry and exit. Smooth, no resistance, excellent execution, just the way we love it. However, there was one amusing incident that I think you’ll enjoy. So, today, I didn’t participate in the NY open. I arrived home at 15:30 UTC +1, enjoyed two wraps with boiled eggs, had my coffee, and then headed to my room.

This is when the excitement begins. It’s time to get into the zone. Put on your game face, look in the mirror, pump yourself up with confidence, and remind yourself that you’ve got this. Now, we sit at our desk, fire up the PC, and launch Discord. My buddy and mentorship participant Dario was already waiting in the VC when I joined around 15:38. Simultaneously, I started my ProRealTime Trading software. On the left side of my desk, I have a 34-inch ultrawide monitor displaying my TradingView charts. On the right side, there’s a 27-inch iMac running my trading software. It’s a fantastic setup, but an additional mega ultrawide display on top would be the cherry on top, allowing me to display my Nasdaq, Dow Jones, and DXY charts simultaneously (I have a thing for large displays).

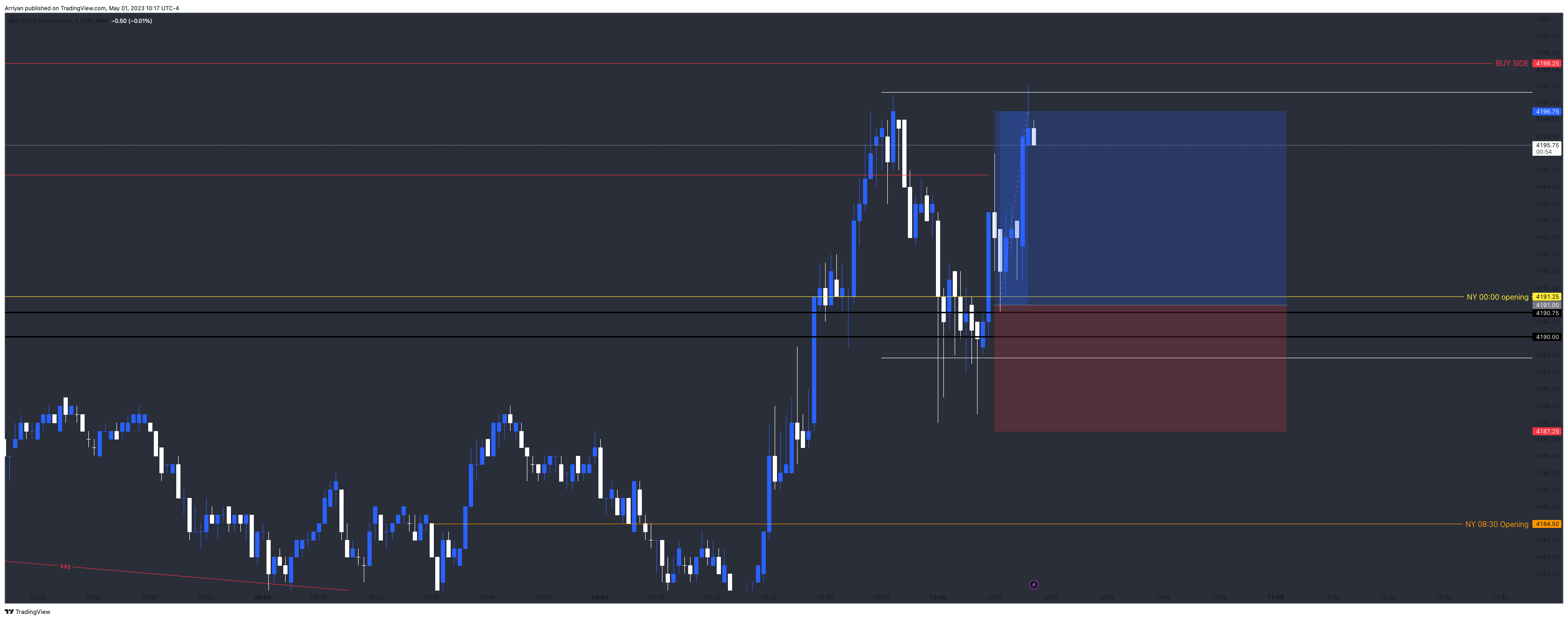

At 15:40, I marked my NWOG (New Week Opening Gap) on the ES1! chart. I observed that the price had respected it a few times, broken below, and then climbed back above and retested it—a classic sign of continuation. It was too late to enter right there, so I waited patiently. At 10 AM New York Time, the ISM Manufacturing PMI news report was published, pushing the price back down and presenting a perfect setup, thanks to the long wicks and increased volatility. News and volatility create opportunities like no other. I spotted a Fair Value gap on the 10:09 candle with an enticing Orderblock (10:06 and 10:07 candle) just in front of it. I thought, “This is my silver bullet!”. I hurriedly reached for my limit order tool and dragged it onto my chart. But here comes the hilarious part – as I was dragging the tool down, the price dipped below. I let go of the limit order tool, which created a limit sell since the order was placed above the current price at that moment. I wanted to go long, though!

I thought “shit homie, tf did I just do?!”. I quickly closed the trade and reversed it before missing my silver bullet. Thankfully, I managed to do so in time. The price grazed my entry, hovered there, consolidated for just over 4 minutes, and then began to rise. Meanwhile, Dario and I were discussing the EUR/USD and potential developments there. Three minutes later, I interrupted Dario mid-sentence. I told him to hold on, “Bro, wait, listen to this,” and a few seconds later, a computerized voice announced, “Buy Limit executed, exit with gains.” My price target was reached within 3 minutes after the consolidation. In 7 minutes, with no drawdown, 5 handles, bagged and tagged.

ICT assigned us the task of securing 15 handles this week with a maximum of two losing trades and only one contract at a time, due to the anticipated news reports this week. 5 down, 10 to go.

I hope you enjoyed this detailed story of my trading day. If you did, stay tuned for more!